By Theresa Cagle Fry, Senior Vice President and Manager IRAs, Retirement & Education Planning

Print This Post

Print This Post

If you have been considering a Roth conversion, there are only a few weeks left in the year for the conversion to count as a taxable transaction for 2022. Anyone can choose to convert existing traditional IRA assets to a Roth IRA, but conversion comes with a cost – you pay income taxes on the amount you convert in the year you convert.

Why would you consider a Roth conversion? The transition can be advantageous if you think you will be in the same or higher income tax bracket in retirement and you:

- Desire tax-free retirement income (after five years and age 59½),

- Want to reduce or possibly eliminate required minimum distributions during your lifetime, or

- Desire tax-free income for your heirs after your death.

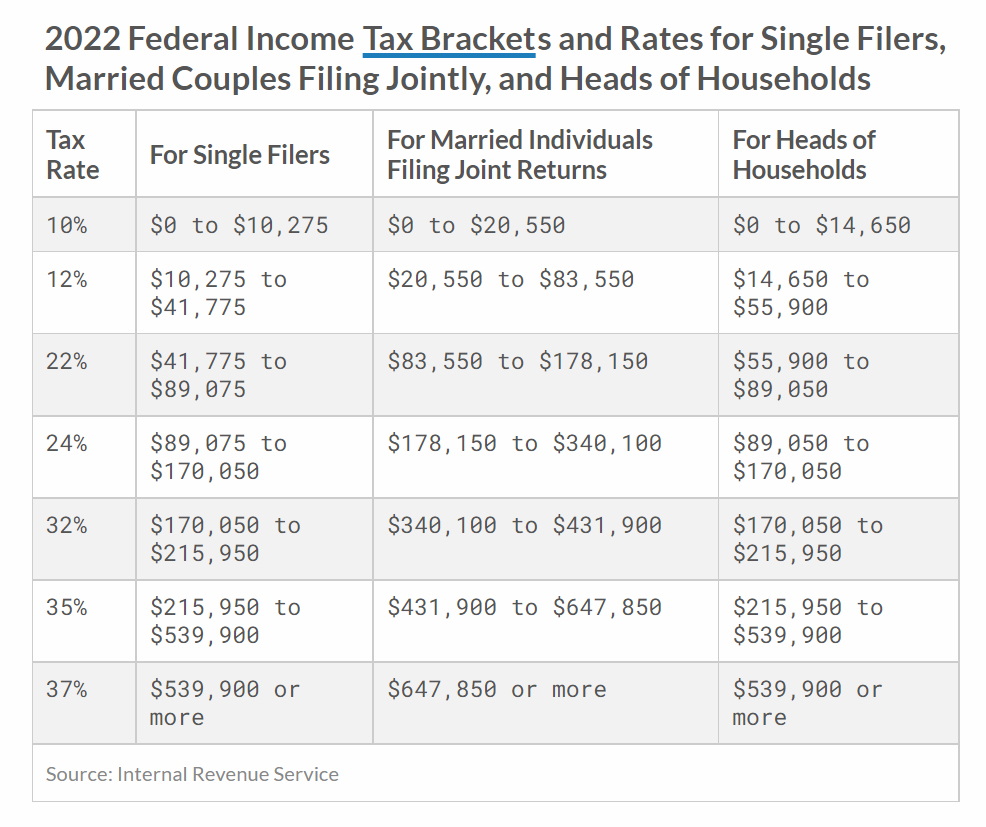

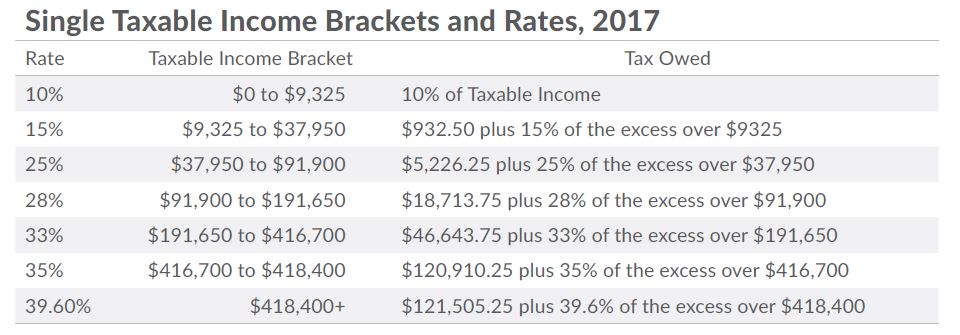

Current Tax Rates Scheduled to Sunset in 2025

Although it’s impossible to predict future income tax rates, keep in mind that the tax rates that are in place today were lowered with the enactment of the Tax Cuts and Jobs Act in 2017 and those lower rates are scheduled to sunset at the end of 2025. If that were to happen, both the tax rates and the income thresholds would revert in 2026 to what they used to be in 2017, bringing back 39.6% as the highest income tax rate. Here’s a comparison of the tax rates today compared to what they were in 2017 for a married couple filing a joint return[i]:

Additional tax policy changes could take place over the next few years that might alter the course of the current sunsetting rates. Since there are a few years until that would happen, one strategy to consider would be to systematically convert your current IRA holdings to a Roth IRA over the next four years. By doing so, you can take advantage of the lower income tax rates and better manage the additional taxable income that results from the annual conversions.

Back-Door Roth Conversions

Another conversion strategy that could warrant a review before the end of 2022 is a back-door Roth conversion. For higher income individuals – who have no other IRAs and are ineligible to make annual Roth IRA contributions – it reduces the cost of the conversion to the amount earned in the traditional IRA between the date of the contribution and conversion. This involves making non-deductible (after-tax) contributions to a traditional IRA and then immediately converting to a Roth IRA. However, if there are existing IRA balances, special income tax rules apply when you contribute after-tax dollars, making the benefits of a back-door Roth conversion less desirable.

Funding a Roth IRA through the “back door” can be beneficial not only because it gives higher income individuals the ability to utilize Roth IRAs to save when their income would otherwise prevent it, but also because it starts the five-year holding period for future tax-free distribution of earnings after age 59½. This is particularly helpful if you have been contributing to a designated Roth account in your 401(k), 403(b) or 457(b) where there are no income limits that prevent your contributions. At your retirement or separation from service, balances in a Roth 401(k) would be eligible for rollover to a Roth IRA. Because those rollovers don’t carry the holding period from the plan into the Roth IRA, rolling into a pre-existing Roth IRA means your five-year holding period has already begun and you are not starting over with having to satisfy the five-year rule.

Conversion is not right for everyone, and you should review your individual circumstances with a tax professional prior to making a decision to convert because once you convert, you cannot undo it.

Benjamin F. Edwards does not provide legal or tax advice, therefore it is also important to consult with your legal and tax professionals for additional guidance tailored to your specific situation.

[i] Source: The Tax Foundation, 2022 Tax Brackets and Federal Income Tax Rates | Tax Foundation and 2017 Tax Brackets | Center for Federal Tax Policy | Tax Foundation