By Pete Biebel, Senior Vice President

The stock market has enjoyed an incredible rally in the final months of 2019. It was pretty much the exact opposite of the way stocks performed in late-2018. A year ago, stocks were finishing a rough December, and that came after a not-so-good October and November. Stocks had fallen steeply with the worst negative momentum in years. A year ago, in late-December, I published what I hoped were calming words in my assessment of the then current conditions. This was my assessment a year ago, warts and all:

- The worst is probably over.

- The odds of at least one lower low are still pretty strong, but that low will probably not be worse than another 4 to 6% lower.

- Volatility is likely at or very near a peak. Expect volatility to gradually subside to more traditional levels into late-January and February.

- Many stocks seem to already have declined to bargain prices, but the current negative momentum suggests that there’s no rush to buy.

- Economic conditions are pretty good, but growth is slowing.

- The Fed and its Chairman Powell are being blamed for a lot of market reaction in which other factors are much more significant catalysts.

- Corporate profits are strong, but their rate of growth is probably also slowing.

- To me the biggest wild-card going forward is not the Fed, not trade talks, not the budget ceiling/shutdown, but the junk bond and leveraged loan credit markets. The markets have been selling-off steeply even as the Treasury market rallied. If that trend continues, it would be a bad omen for the stock market.

- Where the recent detours (mentioned above) were followed by new highs in five or six months, I’m guessing it’ll take longer this time.

- As the market works to find a low and form a bottom, keep in mind that it may be creating perhaps the best buying opportunity in several years and for several more to come.

Turns out the worst was indeed over. There was no lower low and volatility did indeed subside. The Fed’s pivot to dovishness was a significant catalyst for the market’s rebound through the first couple months of the year. Corporate profit growth did indeed slow in 2019 but was strong enough to avoid any further threat to the junk bond and leveraged loan markets. It took the S&P 500 Index (SPX) and the NASDAQ Composite Index (COMP) about four months to get back to the old highs but it took more than six months to move much beyond those highs. The Dow Jones Industrial Average (DJIA) didn’t get much beyond its October 2018 high until this past November. And finally, the late-2018 sell-off did indeed create the best buying opportunity in years in most sectors and most individual stocks.

Thankfully, this year there’s no need to write about coping with a market downdraft. Quite the opposite. The Fed-fueled strength in the market in the final months of 2019 has pushed the major averages to new highs. Hints and tweets of possible trade talk progress provided an extra boost for stocks. The market’s expectations for the economy have gotten much rosier in recent months. Where last year’s late weakness presented a good buying opportunity, it seems that this year’s late strength has lifted the market well into an over-bought condition.

The market seems to have already priced-in all the good news on the Fed, the economy, corporate earnings and the trade war. The rally over the past few months has pushed the averages to such an extended condition that we can be fairly confident that, while the current upward momentum may help the averages move a little higher in the short-term, significant further upside progress seems doubtful over the next four to six months.

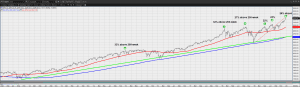

The long-term chart of SPX below highlights the several occasions upon which the index climbed to more than 25% above its 200-week moving average (the blue line for those of you reading in color) in the past nine years. You’ll see that there is no magic level of overbought-ness. Even now we can’t rule out that SPX could be 35% to 40% above that long-term average in the coming weeks. It’s just very unlikely. You’ll also see that extreme overbought-ness doesn’t mean that the market must sell-off, but it’s probably safe to conclude that the market’s performance in the months following such a condition is likely to be clearly inferior to that which preceded it.

The chart also shows that the market is currently very near as extended as it got on two occasions in 2018. The green arrows on the chart indicate overbought conditions and the two green arrows in 2018 (not so coincidentally) coincide with two of my more cautionary articles. When a similar condition was evident in January of 2018 I titled an article “Uber Exuberance” to call attention to the excessive optimism and the heightened short-term risk in the market. Eight months later, in September, with the indices slightly above their January peaks, my article “It Ain’t Gettin’ Any Greener” theorized that the market had priced-in all the good news and that, in an over-extended market, a little bad news could go a long way.

With all that as a backdrop, here’s my assessment of the market as it enters 2020, warts and all.

- The best is probably over, at least for a little while. The stock market’s big rally in late-2019 pushed it into a statistically over-bought condition from which it is unlikely to see significant additional appreciation in the next several months.

- This could be a good time to rebalance portfolios. The strong stock market gains last year probably caused portfolios to become over-weighted in equities in general and U.S. equities in particular.

- The good news is already priced in. The market will need more and better news to continue higher but is more likely to be disappointed by news, especially on the trade talks.

- The Fed is out of good news. The repos could continue but any significant policy change will likely be bad news or in reaction to other bad news.

- Without bad news, I have no reason to expect a bad year. Many analysts expect the market to be making new highs later in the year as the election comes into focus.

- Without bad news, any technical, short-term danger signal in the market seems very unlikely in the early part of 2020. Upward momentum is strong and will take some time to dissipate. SPX, which is finishing the year a bit above 3200, would need to fall to near the 3000 level before any technical alarms would be triggered.

- The best bet seems to be for SPX to spend the first quarter of the year in the 3100 – 3300 range.

As 2020 begins, the U.S./China trade negotiations continue to be the topic to which the stock market is most sensitive. The market still doesn’t seem to be too concerned about the impeachment proceedings but will be paying more and more attention to politics through the primaries and into the election. The Healthcare sector, which has made a remarkable recovery over the past few months as promises of “Medicare for all” have faded, could be susceptible to further political threats in the New Year. Stocks in the Energy sector have underperformed for years and may represent the best values currently. The Real Estate and Utility sectors seem to be the most overvalued currently.

Chart courtesy Pershing MarketQ and Interactive Data Corp.

Please note that rebalancing investments may cause investors to incur transaction costs and, when rebalancing a non-retirement account, taxable events will be created that may increase your tax liability. Rebalancing a portfolio cannot assure a profit or protect against loss in any given market environment.

Links to previously published commentaries can be found at benjaminfedwards.com/For Our Clients/Educational Resources/Market.